reit dividend tax rate 2021

Dividend Tax Rates for the 2021 Tax Year. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

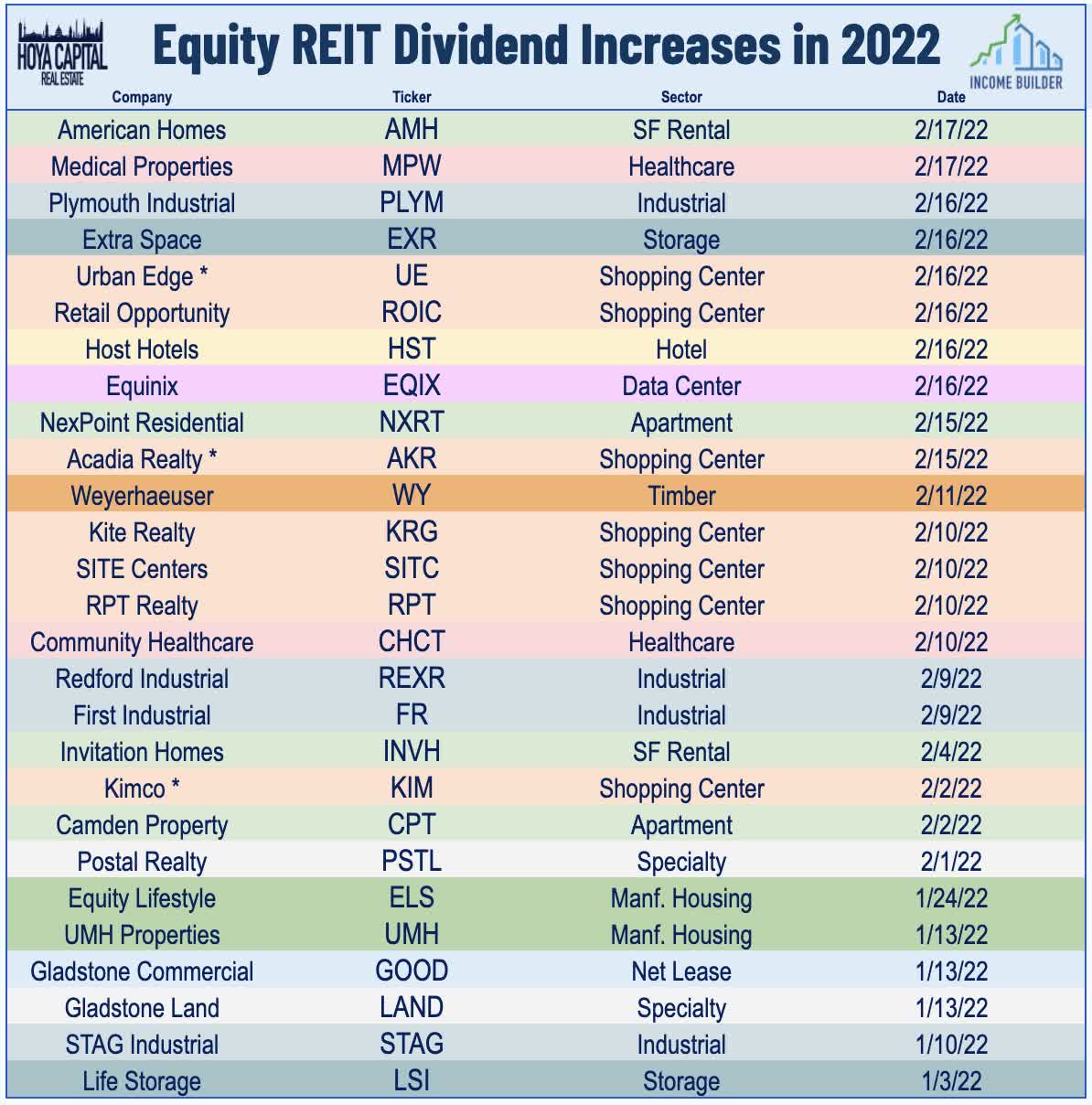

Buying The Reit Correction Seeking Alpha

30 tax rate if shareholder owns 25 or more of the REITs stock.

. Tax rate on dividend income The dividend income in the hands of a non-resident person including FPIs and non- resident Indian citizens NRIs is taxable at the rate of 20 without. These investments offer a solution to those. This in contrast to normal company earnings which are taxed at 28 within the.

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. 2021 Ordinary Dividends. Billion pesos in its PSE.

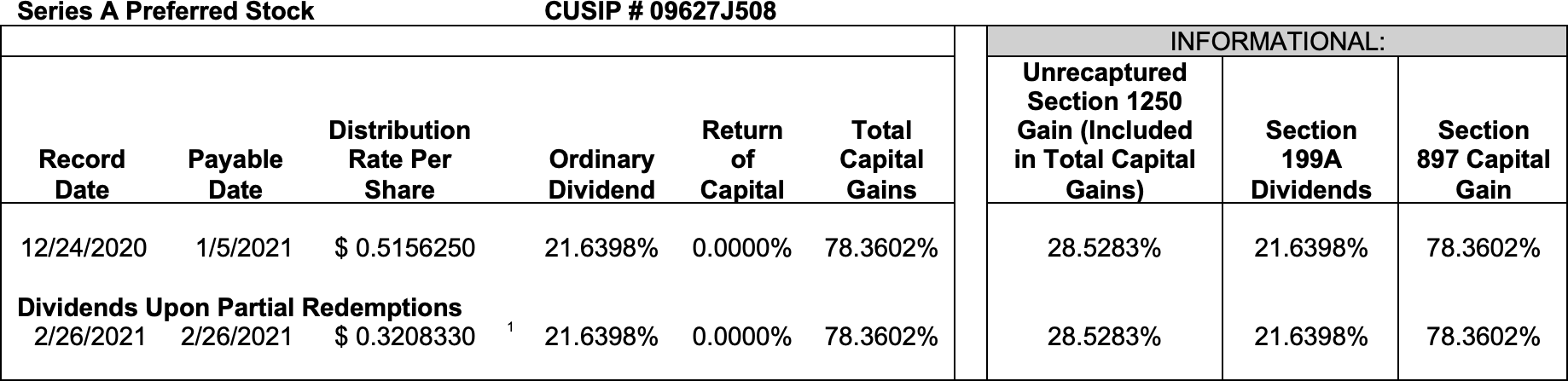

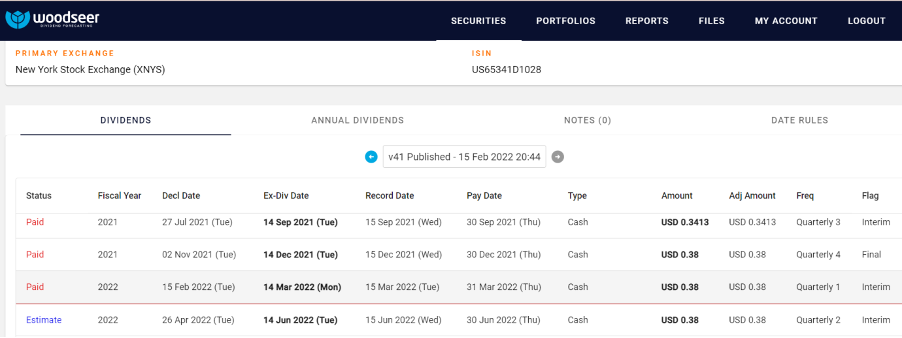

ROC is referred to as a reduction in adjusted cost base. 2021 Qualified Dividends 1 2021 Capital Gain Distributions. RCR RL Commercial REIT Inc One of the biggest REIT IPO of 2021.

On dividends on REIT investments until they receive their pension payments for the funds. Stephanie Colestock Nov 12 2021. Section 199A Dividends 2 Cash.

It requires a good stock tracking system. Are REIT dividends subject to the maximum tax rate. Profits distributed as PID dividends are paid out of British Lands tax-exempt profits and therefore are potentially fully taxable in shareholders hands as property letting income.

2What is the 2021 Withholding Tax Rate for 2021 for Dividends for Indian stocks held in. The Namibian Dividends Tax rate is currently 15 which means that if you hold your shares on the Namibian share register you are entitled to claim a reduced rate of Dividends. PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder.

Granite REIT expects to pay distributions in accordance with its distribution policy determined by its Board of Trustees. Income tax will be deducted as per the provisions of section 194LBA of Indian income-tax Act 1961 the Act by Mindspace Business Parks REIT MREIT on distribution to. 15 tax rate if shareholder.

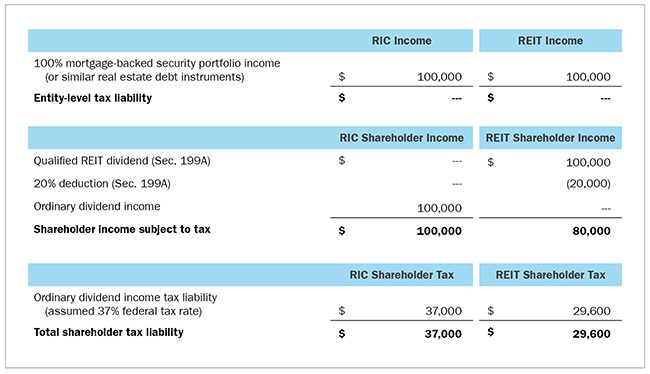

Real estate investment trusts or REITs can be a great addition to a well-diversified portfolio. To provide a similar benefit to passthrough entities Sec. Contacting the helpline asking.

Last Divided Rate. The company has successfully raised 23. Its important to note how long a REIT company owned.

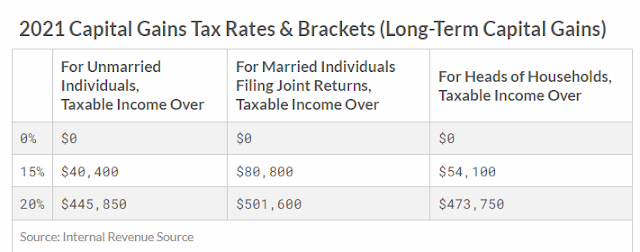

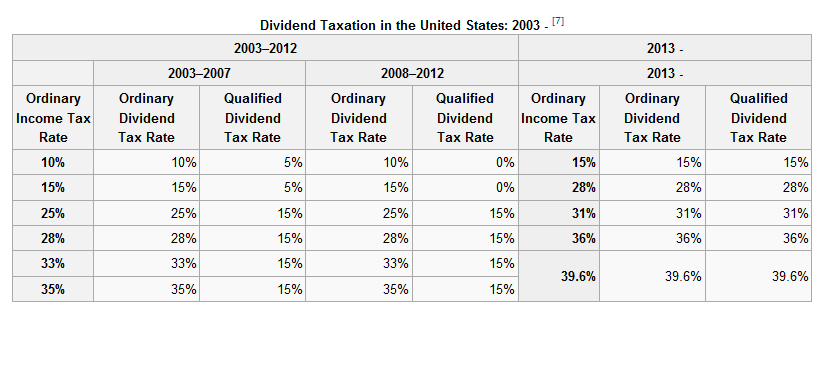

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate. Theres no single tax rate that is applied to REIT dividends and in fact the same REIT dividend could be made up of several different kinds of income. There is no immediate tax to pay on it as it simply reduces the cost of the share.

The rate of Dividends Tax increased from 15 to 20 for any dividend paid on or after 22 February 2017 irrespective of declaration date unless an exemption or reduced rate is. The distribution rate is established by the Board. The TCJA reduced the top tax rate of domestic C corporations from a maximum of 35 to a flat 21 rate.

Lastly some dividends are paid out as capital gains. Essentially the tax is put off until the dividend is sold at some point in the future. Just like other investment income dividends can be subject to better tax rates than other forms of income if theyre qualified in.

1What is the 2021 Withholding Tax Rate for Dividends paid to US investors. March 31 2021. Jamaica and no more than 25 of the REITs income consists of dividends and interest.

No tax on 2000 of dividends because of the dividend allowance 875 tax on 1000 of dividends Pay tax on up to 10000 in dividends Tell HMRC by. So REITs have a.

1940 Act Reits Vs Rics The Qualified Business Income Deduction Cohen Company

Bluerock Residential Growth Reit Brg Announces 2021 Year End Tax Reporting Information Bluerock Residential Growth Reit

Investing In Reits All You Need To Know A Guide For Your 20s

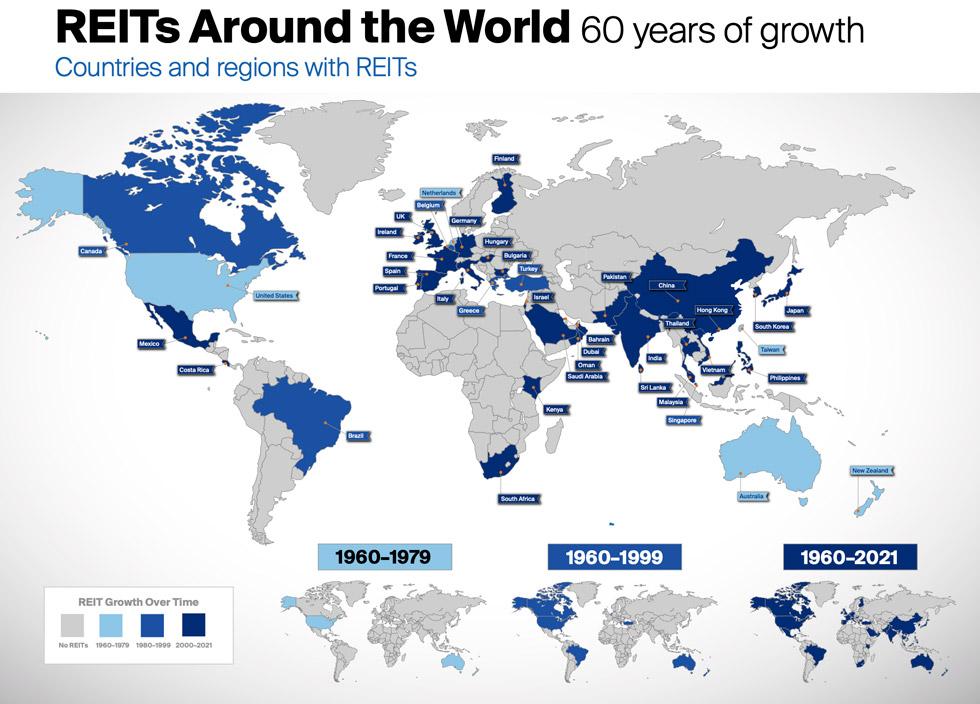

Global Real Estate Investment Nareit

21 Reit Dividends I Love And Hate For 2021 Nasdaq

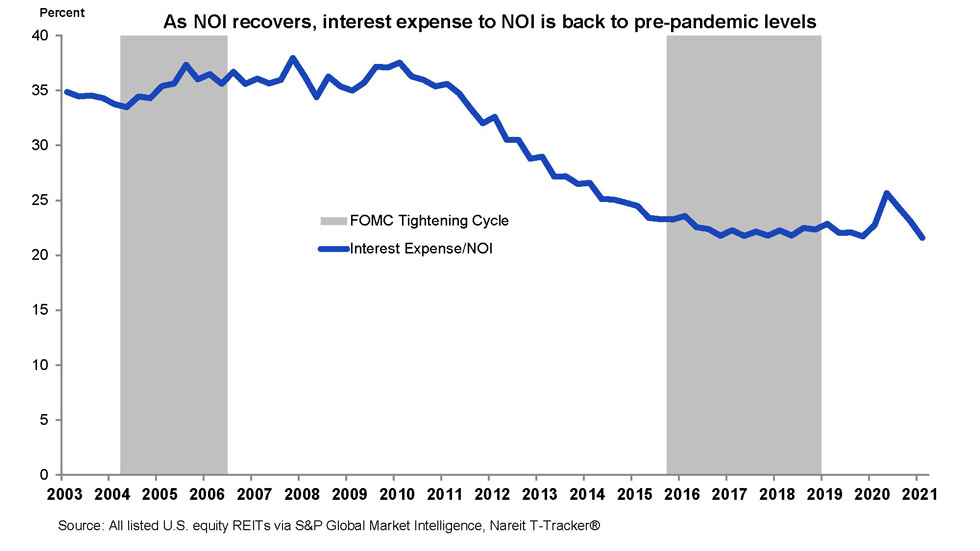

Reit Dividend Outlook In A High Interest Rate And Inflation Environment

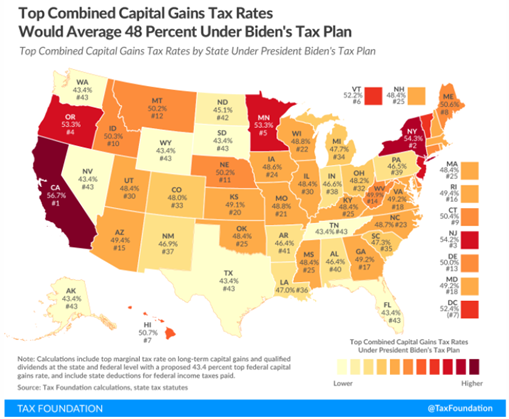

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

Sec 199a And Subchapter M Rics Vs Reits

Real Estate Investment Trusts Tax Implications For Investors

Multifamily Reit Dividends Vs Equitymultiple Investments

Your Dividend Tax Rates 3 Examples Calculate Tax On Your Qualified Dividends Like A Pro Youtube

/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)

What Are Qualified Dividends And How Are They Taxed

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)

Are Reits Beneficial During A High Interest Era

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

What You Need To Know About Capital Gains Tax

Dividends Provide A Tax Efficient Form Of Income Dividend Growth Investor

Reits And Interest Rates Real Estate Investing Nareit

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha