capital gains tax changes 2021

President Biden and his administration have long indicated there would be a change coming to the way capital gains. As proposed the rate hike is already in effect for sales after April 28 2021.

The Tax Impact Of The Long Term Capital Gains Bump Zone

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

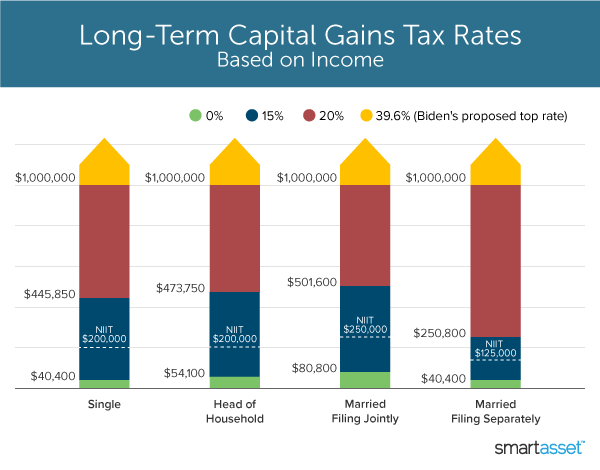

. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. 1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank. The Capital Gains Tax Return BIR Form No.

Crypto tax rates and capital gains for 20212022 - Finder. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

Home Resource Center Proposed Changes to Taxation of Capital Gains. Annual exemption and rates of tax. Those with less income dont pay any taxes.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000. Ad If you have a 500000 portfolio get this must-read guide by Fisher. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Long-term gains still get taxed at rates of 0 15 or 20. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. The new top rate combined with an existing 38 surtax on investment income over. The effective date for this increase would be September 13 2021.

Colorado taxpayers can be exempted from paying state taxes on capital. House Democrats proposed a top federal rate of 25 on long-term capital gains by the House Ways and Means Committee. 1 week ago Aug 17 2021 Current long-term capital gains are taxed at 15 for single taxpayers whose annual income is.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year. Weve got all the 2021 and 2022 capital gains.

The 238 rate may go to 434 an 82 increase. This tax change is targeted to fund a 18 trillion American Families Plan. The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Add state taxes and you may be well over 50. First deduct the Capital Gains tax-free allowance from your taxable gain.

Tax Law Changes 2022 2021 Formula 1 Regulations Include Radical Design Changes Describing extensively the american jobs plan and american families plan tax. Retirement Tips Seniors Will Need If the Capital Gains Tax Changes. Following enormous spending in 2020 due to Covid-19 The Government is considering tax increases to raise revenue to mitigate the.

Its one of the biggest tax changes in more than a decade for Colorado. CAPITAL GAINS TAX -CHANGES FOR 2021. 1 week ago Mar 30 2022 If youre married filing jointly with a combined income of 100000 you might pay 22 in taxes on your.

The maximum rate would be 288 when combined. Add this to your taxable income.

Analyzing Biden S New American Families Plan Tax Proposal

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

State Taxes On Capital Gains Center On Budget And Policy Priorities

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

Mechanics Of The 0 Long Term Capital Gains Rate

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2020 2021 Capital Gains And Dividend Tax Rates Wsj

President Biden S Capital Gains Tax Plan Forbes Advisor

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The Kind Of Change We Need Senate Oks Capital Gains Tax The Stand The Stand

2019 2021 Capital Gains Tax Rates Go Curry Cracker

Capital Gains Trade Nears Potential Deadline As Legislation Looms

What S In Biden S Capital Gains Tax Plan Smartasset

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

State Capital Gains Taxes Where Should You Sell Biglaw Investor